Everyone wants their product to go viral. Why wouldn’t you? It’s like the holy grail of marketing.

Too bad it’s BS.

If virality was a “thing” that could be reproduced on demand it would be the only marketing that would exist. Why would you do anything else?

And yet I constantly get marketing services companies pitching me on their ability to make things go ‘viral’. When I advise CMOs at other companies it is one of the top questions asked. My own team regularly asked me what we are doing to get our product to go viral.

Before I demolish the idea of virality completely, I will say there are some basic things you should do. You should make it easy for people to talk about your product. You might want to have a basic referral award system. Ideally you want to make your product visible when it is used.

These are all smart business practices. They should help on the margin, but none of them are going to make or break your business. The rest of this post will explain why virality doesn’t work. A future post will explain why doing some ‘good enough’ things might still be a good idea.

Why Virality Doesn’t Work: It’s all about the funnel

I own my understanding of this concept to Tony Wright. Tony is a friend of mine and the founder of multiple start-ups including RescueTime. He is the best person I personally know at making things go viral. The best example of his experience is CubeDuel. CubeDuel was “Hot or Not for LinkedIn”. When you signed up for CubeDuel it pulled two people from your LinkedIn network and asked you who you would rather work with in the future. If you rated 100 people you could find out your own scores. But when you got to 100 it would almost always say, “Not enough people have rated you yet. Share with friends to get yourself rated.”

It had easy tools for sharing. It was fun to play (lots of pictures buzzing in and out as you made selections. Super fast UI). It had sharing incentives as well as incentives to engage more (“Rank 500 people to see the ratings of your network.” “Rate 1000 people to see the top employees at your company.” “Rate 2000 people to see the top people in your city.” Etc.)

Tony was responsible for most of those features (the basic product was created by Adam Dopplet, co-founder of UrbanSpoon and Dwellable).

CubeDuel was so effective in the early days that it broke LinkedIn. Rumors spread that LinkedIn blocked it because it was too good and they wanted to create the product in-house, but the reality was they just spiked the use of the LinkedIn API so fast that it couldn’t keep up. It was fixed in a day or two.

But “breaking LinkedIn” made a great story. The media picked up on it. It was talked about all over as the ultimate viral product. Its growth was off the chart.

Only Tony shared the numbers with me. It actually wasn’t viral at all.

To understand that, we need a definition of viral.

How do we measure Virality?

The idea of a viral product is one in which your existing customers do your marketing for you. If every one of your customers gets two friends to use your product and each of those gets two of their friends and you can keep up that rate indefinitely you will soon have everyone on the planet using your product. It sounds pretty good.

In fact, it doesn’t even need to be that good for it to be infinitely good. As long as each customer gets >1 friends to use the product, you will eventually get everyone on the planet using it. The number of additional customers each customer acquires for you is called the “virality index”. If your virality index is >1.0 you have a viral product. If it’s less than 1.0 (but greater than zero) you have a product with a word-of-mouth channel that augments (but never replaces) your existing marketing.

On the third episode of “How to Start a Start-up” podcast (an excellent podcast for those who listen to those things), the founder of HomeJoy talks about how important small changes are. She uses the example of how if you can make small changes to get your virality index from 0.98 to 1.02 you have just made your product go viral. While that fact is true on its face, I hope to show you that your initial product does not have anything close to a 0.98 virality index.

The way to do that is to think about funnels.

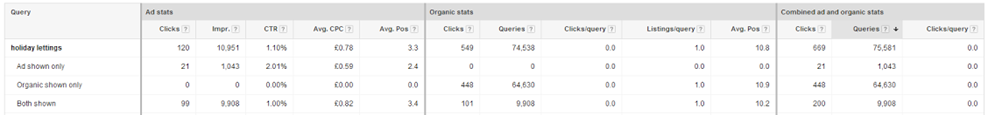

Let’s focus on sharing your product through one particular channel: Email referrals (this same method applies to every channel, but this particular one has a long history of quantifiable metrics which makes the example more powerful).

Your product looks like this:

- You ask your users to share your product with friends

- Your users email their friends about the product

- Those friends read the email and click through to your ‘sales pitch’

- They read your pitch and register for your product

Voila. Virality.

If the numbers are high enough.

Let’s go through some benchmark numbers. We will be very optimistic.

- Let’s say you get 100% of your users to share your product with their friends (well done! Sounds like an amazing product!)

- Let’s say each of them shares your product with 100 of their friends they think would like your product

- Each of those friends receive an email. A very good email open rate is 20%. Let’s say because it’s coming from friend we get double that. 40% open rates.

- These potential customers read the email and some decide to click through to your full sales pitch. A great click-through-rate (CTR) is 5%. We double that again to 10%.

- They land on your pitch page. A great sign-up rate for a free product is about 10% (that would be ridiculously high for a paid product). Let’s say you get 20%.

That funnel looks ridiculously implausible. But let’s see what it’s virality index is.

100% send rate x 100 contacts x 20% open rate x 10% CTR x 20% conversion rate = 0.4 Virality index

This means that every customer you sign-up will get an additional 0.4 customers for you (And those customers will get you an additional 0.4, who will get you an additional 0.4, etc.). It’s a pretty great scenario – when all is said and done for every customer you acquire with traditional channels you pick up an additional 0.66 customers. That should let you spend more on traditional marketing, but it sure isn’t going to be ‘viral’.

And remember we made up ridiculously unrealistic funnel metrics. More realistic funnel metrics would look something like this:

10% send rate x 50 contacts x 10% open rate x 5% CTR x 10% conversion rate = 0.0025 Virality index

Every thousand customers is getting you an additional 2.5 customers. Ouch.

So why does anything go viral?

I just proved it’s impossible for something to go viral. And yet Instagram, Farmville and Gangnam Style all exist. Have I just claimed they are impossible?

Kind of.

I’m claiming that trying to be the next Instagram or Farmville is a lot like trying to get hit by lightning a couple of times. Many people have been hit by lightning twice (in the same day or even seven times), but it’s pretty random. The same is true for going viral. Every metric will vary within a bell curve. Sometimes a metric will be very far to the right on a bell curve. When that happens we call it viral and start trying to rationalize why it happened.

You DO have influence on many of those metrics. You can make it easy to send out the email to someone’s entire address book; You can provide incentives to send it to both customer and potential customers; You can create compelling emails and landing pages that have high conversion rates. All of those things will make your product ‘more viral’, but in no world can it increase the expected virality function anywhere close to 1.0. For that you need luck.

Or specific types of products that can skip the funnel altogether.

Viral Products

A good way to identify a viral product is to see if it skips part of the funnel. If something about the product lets it get a 100% rate in a part of the funnel where normal (or great) products have a 20% rate, that’s a big difference. If a product can do that a few different parts of the funnel, it has a reasonable chance of actually going viral.

Let’s look at Farmville.

Farmville was the first in a series of games that took advantage of the Facebook platform to go viral. Let’s look at what their funnel might have looked like.

- 100%of users shared Farmville with their friends (built into the game)

- Initially they shared it with all of their facebook friends. Let’s say the average number of friends was 400 people

- At the time the feed was a feed of everything happening in your network (Facebook wasn’t screening for the best stuff), so we can assume, sooner or later, 100% of your friends saw your Farmville update. In fact we can go further. Most friends would see your update multiple times, giving them many chances to respond. It was kind of like you were emailing your entire address book every day over and over and almost every email was getting opened. Let’s estimate that each person in your network saw your update an average of five times (this may be too low)

- CTR might be a little higher than average at the beginning until people understood what this was. Let’s say it was 5%.

- Let’s say sign-up to play Farmville was a standard 10%

What is Farmville’s virality coefficient?

100% x 400 x 5 x 5% x 10% = 10

Ten!

Every user of Farmville adds ten additional users of Farmville!

Remember a great virality number is anything over 1.0. Farmville should have blown up (it did for a while), and then it should have kept blowing up until everyone who ever logged into Facebook was playing (And I know that is not true as I have never played a game of Farmville). At a 10x coefficient, assuming each ‘hop’ from one set of users to the next took a week, it would only take 9 weeks to have a billion users of Farmville. In 10 weeks therewould be more users of Farmville than there are people on the planet.

Assuming the funnel is right and Farmville is not 100% penetrated into Facebook users, what’s wrong with our math? We left out one factor: Inoculation.

Inoculating Viruses

There are always people who are immune to every virus. The same is true of viral products. No amount of awareness and exposure was going to get me to play Farmville. And as Farmville expanded the percent of people who were not interested became a higher and higher percentage of the people their “virality” was targeting. Its growth slowed down, stopped and eventually went into reverse. (But it sure was a good run while it lasted!)

Farmville had a very high inoculation rate. Even though it’s vitality ratio was off the chart, it’s inoculation rate served to slow down it’s exponential growth and hurt it’s (very) long term prospects.

It’s a function of the universe that every viral product will eventually hit an inoculated population, but some hit it much faster than others. Farmville’s inoculation index was particularly high. Not only was a large population immune, but many people who used the product dropped off. While some people became very addicted and played a lot (and shared a lot), the friends of the addicted group quickly became immune to the virus. And Farmville died.

Not every viral product looks like Farmville.

Consider Instagram.

Instagram had similar characteristics to Farmville. Every time a user took a cool photo with an Instagram filter and shared it with friends it was an advertisement for the product. The Instagram filters were shared with user’s friends over and over again. But unlike Farmville seeing different cool photos one after another from different friends was less likely to make you annoyed and more likely to make you interested in figuring out how YOU could make cool photos like that. The virality effect actually went UP over time. And unlike Farmville it was not a small number of power users who stuck with the product. Instagram had a very high customer retention rate, so even if the virality effect slowed down over time, net user growth stayed positive due to low levels of churn.

CubeDuel

Which brings us back to CubeDuel. According to Tony, CubeDuel had a very high virality index of about 0.7. That was enough that every time they signed up a user from a traditional marketing channel they picked up another 2.25 additional users through viral spreading. That is pretty awesome. But it only works as long as you continue to prime the pumps with new users. You can’t just sit back and let the virality take over.

The next piece of good news was that CubeDuel was getting lots of media coverage (remember “The Product That Broke LinkedIn”?). Coverage begets coverage. After the story of breaking LinkedIn there were a series of stories about how viral the product was (Little did the reporters know it wasn’t actually viral at all!).

Tony and Adam saw the writing on the wall. They knew the product would take off as the 0.7 virality function did its work to build on the press coverage, but they also knew that as the press coverage died down eventually the traffic will dive down too. Their product was great and fun to use, but it wasn’t fun to use every day. After playing with the product for a while, users were ready to move on.

Tony and Adam sold CubeDuel to investors who were more optimistic they could continue to make the product go viral.

Today?

CubeDuel.com redirects to RedCross.org.

So irrational exuperence in virality is at least getting a little more traffic to a respected charity.

Unless that is the plan for your business, focus on more traditional marketing channels and don’t count on virality to make your business plan.